ECCTA: The Biggest Corporate Governance Shake-Up in 20 Years

The Economic Crime and Corporate Transparency Act (ECCTA) represents the most significant changes to corporate governance in decades.

This transformative legislation, enacted with the intent to tackle economic crime and promote transparency, is poised to reshape how UK companies and corporate entities operate.

With its focus on preventing fraud, strengthening regulatory frameworks, and enhancing accountability, the ECCTA marks a new era in corporate governance.

Recieving royal assent in 2023, ECCTA introduces a range of new requirements that impact everything from registered office addresses to the responsibilities of company directors.

By empowering regulatory bodies and law enforcement agencies with new powers, the Act seeks to deter money laundering, address misuse of corporate structures, and create a safer, more transparent business environment in the UK.

This monumental shift sets the stage for future activities aimed at fostering economic growth and corporate responsibility.

Understanding the Economic Crime and Corporate Transparency Act

Key Features of the Corporate Transparency Act

The Economic Crime and Corporate Transparency Act introduces groundbreaking measures designed to prevent fraud and tackle economic crime.

One of the most notable changes is the implementation of new rules aimed at increasing transparency across corporate entities.

These rules require enhanced data sharing and stricter trust information disclosures, ensuring that the activities of UK companies are closely monitored to deter financial wrongdoing.

Companies House has been granted new powers to oversee corporate structures and address issues such as the misuse of registered office addresses and inaccurate information in company registers.

The Act also emphasizes company secretarial responsibilities, urging senior managers and existing directors to ensure compliance with the latest corporate governance standards. This shift will likely increase the demand for legal advice as businesses navigate the complexities of the new legislation. Indeed, the need for identity verification has spawned a new industry of Authorised Corporate Service Providers of which Edward Young Notaries & Lawyers are one. Click to access our ACSP service

Additionally, the Economic Crime and Corporate Transparency Act introduces stricter regulations for third-party agents acting on behalf of companies.

These changes are designed to hold authorised corporate service providers and other third parties accountable, further reducing opportunities for fraudulent activities. By strengthening the role of regulatory bodies, the UK government aims to create a more transparent and secure corporate environment.

Enhancing the Business Environment in the Coming Years

ECCTA’s overarching goal is to enhance the UK business environment by fostering transparency and accountability.

By addressing long-standing issues such as money laundering and the misuse of corporate directors, the Act seeks to encourage economic growth while simultaneously protecting legitimate businesses.

The introduction of a more robust verification process for company names and registered email addresses ensures that all legal entities operating in the UK adhere to high standards of corporate governance.

One of the most significant changes is the creation of new offence categories targeting the misuse of corporate structures.

These offences, coupled with stricter penalties, including financial penalties and civil penalties, are expected to deter illegal activities and promote ethical business practices. Furthermore, the Act prioritizes tackling anti-money laundering activities by improving collaboration between law enforcement agencies and regulatory bodies.

This collaboration will help identify and address risks associated with limited partnerships and limited liability partnerships.

Over the coming years, businesses can expect to see a stronger emphasis on maintaining accurate and up-to-date company registers.

The inclusion of information such as residential addresses and significant control disclosures will make it easier to identify and hold accountable those involved in fraudulent activities. The ECCTA also supports economic growth by creating a level playing field for all companies, ensuring that the UK remains an attractive destination for legitimate business ventures.

Impact on UK Companies and Corporate Entities

Filing Requirements and the Annual Confirmation Statement

ECCTA introduces several changes to filing requirements, particularly with regard to the annual confirmation statement.

Under the updated Companies Act 2006, companies are now required to include additional financial details, such as the balance sheet total and profit and loss accounts, in their filings.

These updates aim to improve the accuracy and transparency of financial reporting, providing stakeholders with a clearer picture of a company’s financial health.

Another important change is the requirement for companies to provide a registered email address and an appropriate address for correspondence.

These measures are intended to streamline communication and reduce instances of inaccurate information being submitted to Companies House.

Moreover, the enhanced confirmation statement filing process will include stricter verification requirements, making it harder for fraudulent actors to exploit the system.

By introducing these new requirements, ECCTA strengthens the role of the registrar of companies in maintaining an accurate and reliable public register.

This ensures that stakeholders, including investors and regulatory bodies, can make informed decisions based on trustworthy data.

Adapting to New Rules for Small Companies and Large Organisations

The new rules set forth by the ECCTA apply to both small companies and large organisations, with specific updates tailored to the unique needs of each. For small companies, the Act provides clarifications on audit exemption criteria and simplifies accounts filing processes to reduce administrative burdens. However, small businesses must still adhere to the stricter transparency standards introduced by the Act, including the requirement to disclose personal information of company directors and senior managers.

Pro tip – not all documents go to the FCDO for Apostille directly. Some have to be notarised first.

Large organisations, on the other hand, face additional responsibilities under the new rules. These include stricter regulations for limited liability partnerships and limited partnerships, as well as increased scrutiny of their financial activities. By enforcing these changes, the UK government aims to create a more accountable and transparent corporate landscape, where all companies, regardless of size, are held to the same high standards.

Preventing Fraud and Strengthening Corporate Governance

Introduction of the Failure to Prevent Fraud Offence

One of the most transformative aspects of the ECCTA is the introduction of the failure to prevent fraud offence.

This new offence holds senior managers and company directors accountable for fraudulent activities carried out within their organisations.

By targeting individuals in positions of significant control, the Act aims to ensure that corporate governance standards are upheld at all levels.

Authorised corporate service providers and third-party agents acting on behalf of companies are also subject to the new offence.

This expanded accountability framework is designed to prevent fraud by ensuring that all parties involved in corporate activities adhere to strict ethical and legal standards.

Businesses are encouraged to seek legal advice to fully understand their obligations under this new framework and avoid potential penalties.

Role of Law Enforcement Agencies and Civil Penalties

Law enforcement agencies play a critical role in the implementation and enforcement of the ECCTA. The Act grants these agencies new powers to investigate and prosecute cases of corporate criminal liability, including offences related to money laundering and fraud. By collaborating with regulatory bodies, law enforcement agencies can more effectively tackle economic crime and ensure compliance with the Act.

Civil penalties, including substantial financial penalties, serve as a deterrent for companies and individuals who fail to comply with the new requirements. These penalties are designed to encourage businesses to prioritize transparency and accountability in their operations. By imposing strict consequences for non-compliance, the ECCTA reinforces the importance of adhering to the highest standards of corporate governance.

New Powers for Companies House and the Registrar of Companies

Verification Process and Tackling Inaccurate Information

The ECCTA grants Companies House and the registrar of companies substantial new powers to ensure the accuracy and reliability of corporate data. A key component of these powers is the enhanced verification process, which requires company directors, senior managers, and other key stakeholders to verify their identities. This measure is aimed at tackling inaccurate information in company registers and public register filings, reducing opportunities for fraudulent activities.

Issues such as the use of po box addresses and discrepancies in residential addresses are also being addressed through these new powers. By ensuring that all registered office addresses and other contact details are accurate, the Act helps to build trust in the corporate system. Additionally, strengthened data sharing protocols and trust information requirements will facilitate better collaboration between law enforcement agencies, regulatory bodies, and government departments, further enhancing transparency.

The new powers also extend to the identification doctrine, allowing Companies House to take decisive action against entities that fail to comply with the new requirements. By focusing on the integrity of filing requirements and the reliability of company data, these measures aim to create a more secure and transparent corporate environment.

How to Verify Your Identity Under the ECCTA

All company directors, people with significant control (PSCs), and others responsible for filings at Companies House will be required to complete a formal identity verification process once the regime comes into force.

Verification can be carried out in one of two ways:

Direct Verification through Companies House

Using the GOV.UK One Login or Companies House digital portal, individuals will be able to upload a passport, biometric residence permit, or other approved photo ID, followed by a short facial recognition or “liveness” check.

Each verified person will then be issued a unique Companies House personal code, which will link their identity to all future company filings.

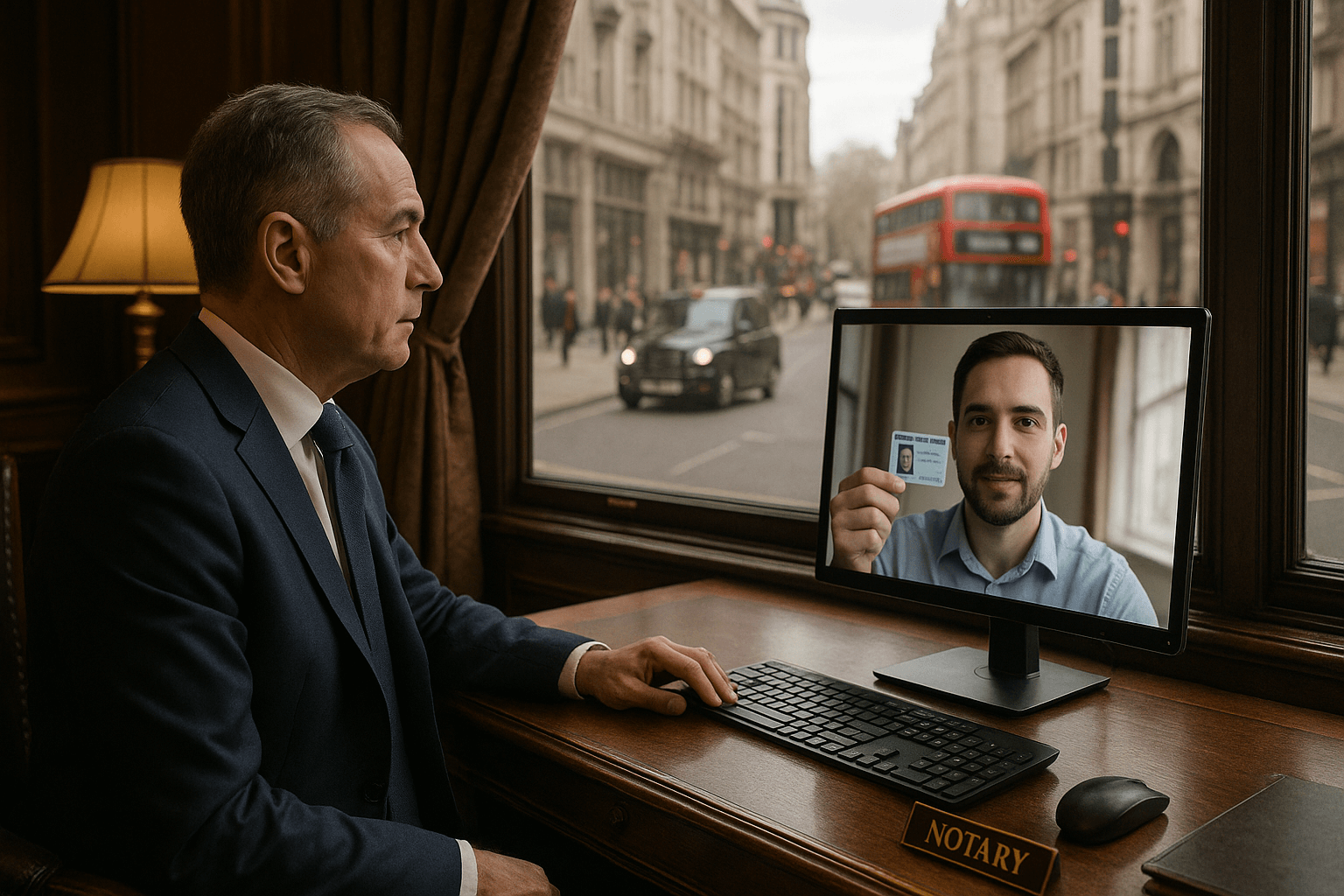

Verification through an Authorised Corporate Service Provider (ACSP)

Solicitors, notaries public, accountants, and company formation agents supervised under UK anti-money-laundering regulations may act as ACSPs.

These professionals can perform identity checks using digital ID verification technology (IDVT) and submit confirmation directly to Companies House on behalf of the client.

For directors based outside the UK, engaging an ACSP is often the simplest and fastest route to compliance.

Required Documents:

- A valid biometric passport (UK or non-UK).

- If no passport is available, another photo ID such as a UK photocard driving licence, biometric residence card, or national identity card.

- A proof of address document (bank statement, utility bill, or tax notice).

It is advisable for small companies to verify all directors at the same time and to record the Companies House personal code securely for future filings.

Practical Compliance Checklist for Small Companies

To prepare for company law reform and ECCTA’s full implementation, small-company directors should take the following steps:

1. Verify Directors’ Identities

Ensure all existing and new directors complete identity verification through Companies House or an Authorised Corporate Service Provider (ACSP).

2. Confirm Registered Details

Check that the company’s registered office and appropriate email addresses are accurate and actively monitored . Remember (PO boxes no longer acceptable).

3. Review Confirmation Statement Procedures

Plan to include new financial information—balance-sheet totals and profit and loss data—in annual filings.

4. Update Internal Records

Keep copies of each director’s Companies House personal code and proof of identity for compliance audits.

5. Strengthen Anti-Fraud Controls

Ensure policies and authorisations are in place to prevent internal or external fraud; this reduces exposure under the new “failure to prevent fraud” offence.

6. Engage Professional Support

Consider appointing a solicitor, notary, or accountant as an ACSP to manage verification and ensure filings meet the new standards.

Small companies that complete these steps early will avoid filing delays, ensure smooth confirmation statement submissions, and demonstrate proactive governance when the new rules become mandatory in 2025

Progress Report on Secondary Legislation and Statutory Instruments

Secondary legislation and statutory instruments play a crucial role in implementing the changes introduced by the ECCTA. Over the coming months, progress reports will outline the steps taken to ensure that the Act’s provisions are effectively integrated into existing frameworks. These updates will provide further information on new offence categories, civil penalties, and changes to the Companies Act 2006.

The introduction of statutory instruments will also address specific areas of corporate governance, such as the use of corporate directors and the filing requirements for limited partnerships. By providing clear guidance on these issues, the UK government aims to support businesses in complying with the new rules while minimizing disruption to their operations.

How the ECCTA Will Shape Corporate Governance in 2025

The Economic Crime and Corporate Transparency Act is set to revolutionize corporate governance by 2025, creating a more transparent, secure, and accountable business environment. By promoting anti-money laundering practices and addressing risks associated with money laundering, the Act ensures that UK companies operate with integrity and fairness. These measures not only enhance trust in corporate entities but also support economic growth on a national scale.

As the ECCTA continues to reshape corporate law reform, stakeholders can look forward to a more seamless and secure browsing experience when accessing public register data on gov.uk. With its emphasis on accountability, transparency, and compliance, the Act sets the foundation for a future where businesses thrive while adhering to the highest standards of ethical conduct.

FAQs

When did the Economic Crime and Corporate Transparency Act receive Royal Assent?

The Act received Royal Assent on 26 October 2023, formally becoming law on that date.

However, many provisions — including identity verification for directors and the new Authorised Corporate Service Provider (ACSP) framework — will come into effect gradually through secondary legislation during 2024 and 2025.

Who must verify their identity under the ECCTA?

All company directors, People with Significant Control (PSCs), and anyone who submits filings to Companies House on behalf of a company must verify their identity.

This applies to:

- Existing and newly appointed directors of limited companies

- Designated members of LLPs

- Partners in limited partnerships

- Corporate directors and their managing officers

Verification will also extend to company formation agents, ACSPs, and overseas directors involved in UK entities.

How can I complete the identity verification process?

You will have two options

What documents are required for identity verification?

Acceptable documents include:

- A biometric passport (UK or non-UK)

- A UK photocard driving licence, biometric residence permit, or national ID card

- Proof of address, such as a utility bill, bank statement, or tax notice issued within the last three months

Overseas directors may need to provide additional verification via video or digital IDVT checks performed by an ACSP.

What happens if a director fails to verify their identity?

A director who fails to complete identity verification may be:

- Prohibited from acting as a company director

- Removed from the Companies House register

- Subject to civil penalties or, in serious cases, criminal sanctions

Companies House will also reject filings made by o n behalf of unverified individuals.

How does the ECCTA affect small companies?

Small companies must still meet the new transparency requirements.

This includes:

- Providing a registered office address that is not a PO Box

- Submitting a registered email address for Companies House correspondence

- Including financial details (balance-sheet totals and profit/loss accounts) in annual filings

- Verifying the identities of all directors and PSCs

Small businesses should act early to ensure smooth compliance before the full regime takes effect in 2025.

What is an Authorised Corporate Service Provider (ACSP)?

An ACSP is a regulated professional (e.g., solicitor, notary public, accountant, or company formation agent) authorised to verify identities on behalf of clients.

ACSPs are supervised for anti-money-laundering compliance and can digitally confirm verification with Companies House.

Using an ACSP is particularly recommended for non-UK directors or companies seeking professional assistance with complex filings.

What is the new “Failure to Prevent Fraud” offence?

This offence makes it a criminal act for a company to fail to prevent fraud committed by employees or associates acting for its benefit.

It holds senior managers and directors accountable where they did not have reasonable procedures to detect or prevent fraudulent acts.

Even small companies should adopt basic anti-fraud policies and internal controls to demonstrate compliance.

How do the new Companies House powers affect businesses?

Companies House now has enhanced powers to:

- Query or reject suspicious or inaccurate filings

- Remove false or non-compliant information from the register

- Share data with law enforcement and regulatory agencies

These powers aim to improve data integrity and reduce misuse of company structures for illicit purposes.

What should directors do now to prepare?

Directors should:

- Gather ID documents for all directors and PSCs

- Designate a compliance lead or engage an ACSP

- Verify registered office and email addresses

- Plan for updated confirmation statements with new financial data

- Adopt anti-fraud policies and keep compliance records ready

Need Help? We Handle the Entire Process

If you need the services of a UK notary, give us a call on our phone number +442074992605, email us notary@notarypubliclondon.co.uk or complete the form below and we will guide you through the process.